The Unified Tokenization

and Trading Ecosystem

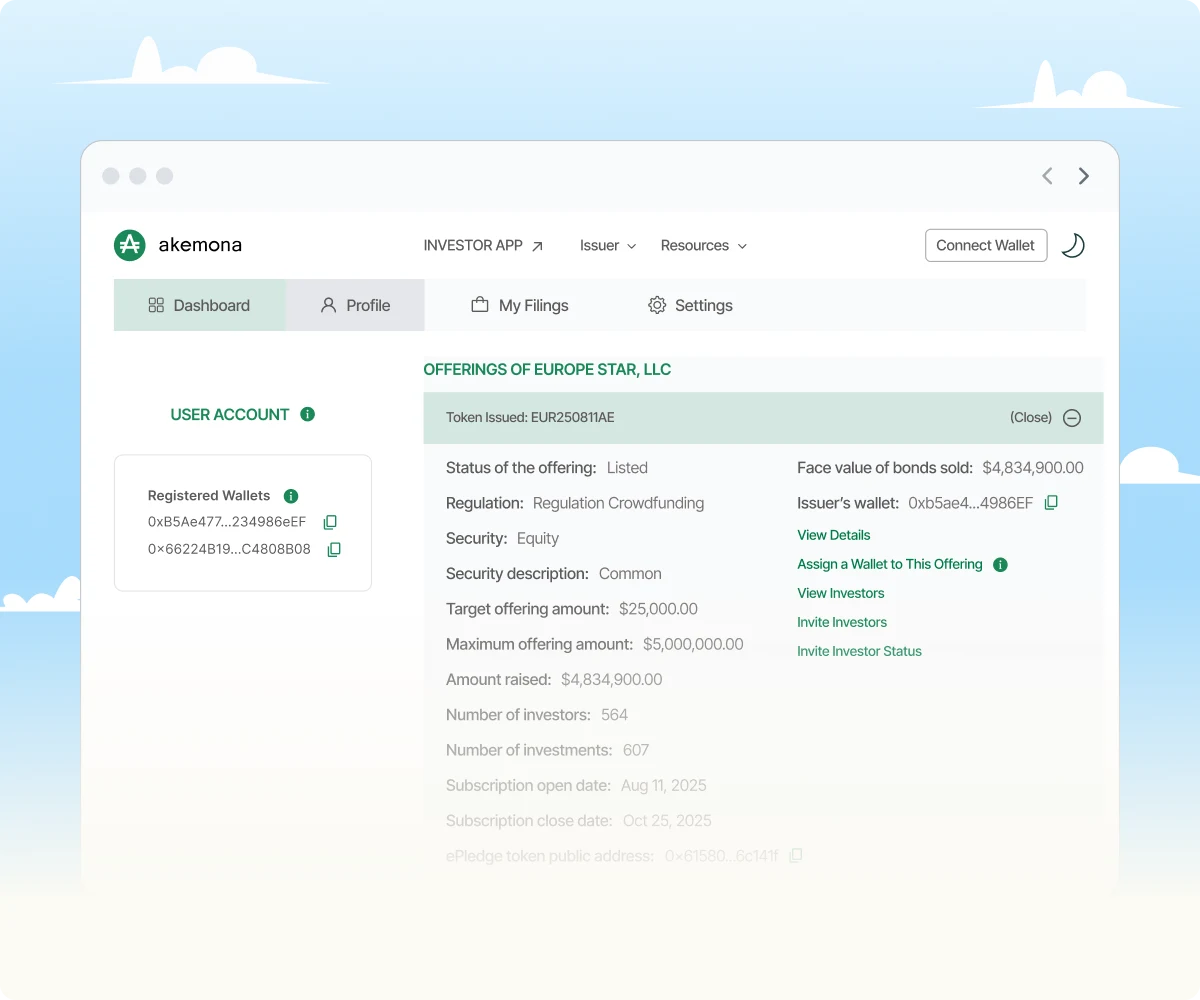

Akemona delivers a complete AI-enhanced digital asset lifecycle infrastructure for financial institutions and enterprises.

Explore the Demo

Tokenize

Use the Akemona Tokenization Cloud to issue digital assets, from securities and stablecoins to utility tokens, under SEC exemptions.

Price

Harness AI FlowBook, our AI-enhanced oracle, to bring intelligent, risk-aware liquidity management to DeFi.

Trade

Unlock automated, compliant secondary market trading with our upcoming AI FlowBook-powered decentralized exchange.

Unlock the Power of Real-World Assets (RWAs)

Akemona’s Tokenization Cloud enables businesses and financial institutions to issue, manage, and trade tokenized securities and digital assets in a transparent, efficient, and scalable way. By integrating DeFi infrastructure with regulatory compliance, we make real-world assets digital, accessible, and future-ready.

Learn More Unlock Intelligent

Liquidity. Safer. Smarter.

With AI FlowBook.

FlowBook reduces impermanent loss, boosts profitability, and strengthens trust in DeFi. By delivering AI-validated, risk-aware data streams, FlowBook aligns AMM performance with order book efficiency.

Reduce Risk: Protect liquidity providers from volatility. Boost Profitability: Capture more fees with smarter execution. Expand ROI: Apply AI FlowBook across DeFi and financial smart contracts, from pricing digital assets to anomaly detection.

Automated Trading with

Built-in Intelligence

We’re extending our ecosystem with an Automated Market Maker (AMM) and Decentralized Exchange built for financial markets, natively integrated with FlowBook.

Trade

Automated trading of tokenized assets

Analyze

Intelligent risk scoring and anomaly detection

Settle

Unified infrastructure for issuance, trading, and settlement

The result: a seamless, compliant environment where issuers, investors, and liquidity providers thrive together.

Why it Matters

Together, the Akemona Tokenization Cloud, FlowBook, and our automated trading platform form a closed-loop ecosystem, covering issuance, liquidity, and post-trade settlement, bridging compliance and innovation.

Issuers

Issuers tokenize and distribute assets faster.

Investors

Investors participate with transparency and lower risk.

Liquidity Providers

Liquidity providers benefit from risk-managed trading environments.

Enterprises

Financial institutions gain a complete, enterprise-grade infrastructure for RWAs and digital assets.